SEC allegedly preparing to sue Terra; After BUSD and USDC, Tether’s market cap reached $70 billion; Sam Bankman-Fried’s bail could be revoked.

SEC allegedly preparing to sue Terra

The US Securities and Exchange Commission (SEC) is preparing to sue Terra, who caused a deep crisis in the cryptocurrency markets last year.

According to Bloomberg’s report, the SEC has turned its direction to Terra this time.

According to people familiar with the matter, the regulator is investigating whether Terraform Labs, the company behind the UST, misled investors about the stablecoin’s 1:1 peg to the US dollar.

An anonymous source stated that it will be claimed that TerraUSD should be registered with the regulator. Terraform Labs noted that the SEC has not contacted them for any action and therefore cannot comment on the matter.

The Terra ecosystem caused a major crisis in the cryptocurrency crisis with its collapse in May. With the domino effect, Three Arrows Capital, Voyager Digital and FTX were directly or indirectly affected and entered the bankruptcy process.

However, the SEC continues to put pressure on the crypto industry. The regulator recently targeted Paxos and BUSD.

The US government had been working on formulas to regulate stablecoins before the collapse of FTX. In 2021, the idea was raised that companies issuing tokens should be regulated like banks.

The whereabouts of Terra founder Do Kwon still remains unclear. Although the South Korean government has issued a warrant for his arrest, Kwon has still not been found. Do Kwon said in a statement on his Twitter account that he denied the accusations.

Sam Bankman-Fried’s bail could be revoked

The terms of bail may be revoked for Sam Bankman-Fried, who has been under house arrest for a while as a result of the decision to be released on bail.

Witness manipulation of Sam Bankman-Fried costs him his bail

As it is known, the former CEO of the bankrupt FTX exchange had recently attempted to manipulate witnesses. This situation is thought to play a major role in the cancellation of the SBF’s bail.

Bankman-Fried could be sent back to prison until his trial next October.

“I don’t understand why I’m being asked to release Bankman-Fried in electronic and internet paradise,” the judge involved in the SBF’s hearing said.

Law professor Richard Painter echoed this sentiment in a February 17 tweet, suggesting that, given the current circumstances, witness manipulation may not be a good idea.

As is known, on February 15, prosecutors requested Judge Kaplan to restrict the SBF’s access to electronic devices.

During the trial, Judge Kaplan argued that it was naive to believe that these restrictions would prevent her from using the internet, given that Bankman-Fried lives with her two parents, who have both computers and cell phones.

On the other hand, on February 9, the former CEO of FTX was banned from using certain messaging apps after it was found that he had contacted potential witnesses. In addition, SBF’s VPN use was also banned.

https://cointelegraph.com/news/sbf-could-conceivably-get-bail-revoked-says-judge

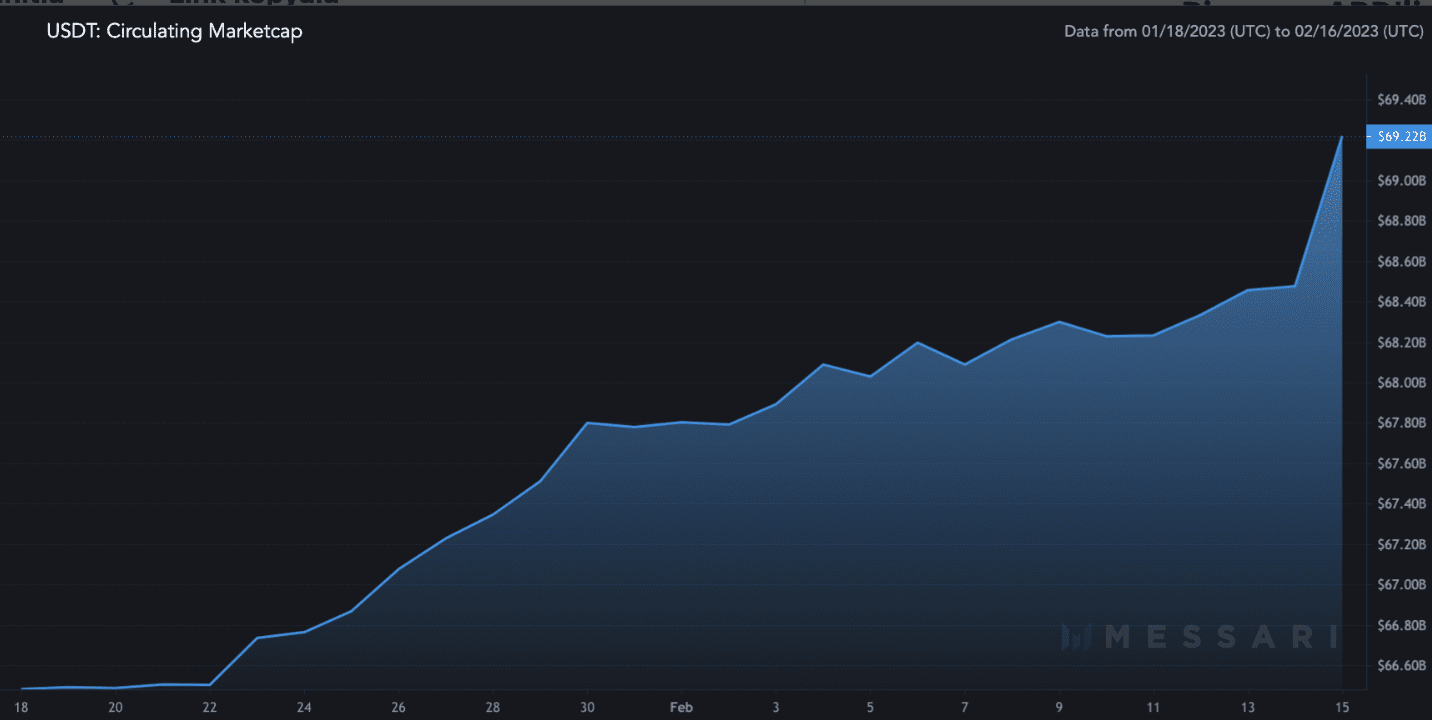

After BUSD and USDC, Tether’s market cap reached $70 billion.

The US Securities and Exchange Commission’s (SEC) plan to sue Paxos seems to have worked for Tether (USDT). While other stablecoin issuance companies struggled, Tether took advantage of the situation and boosted its market value to the highest levels of the last few months.

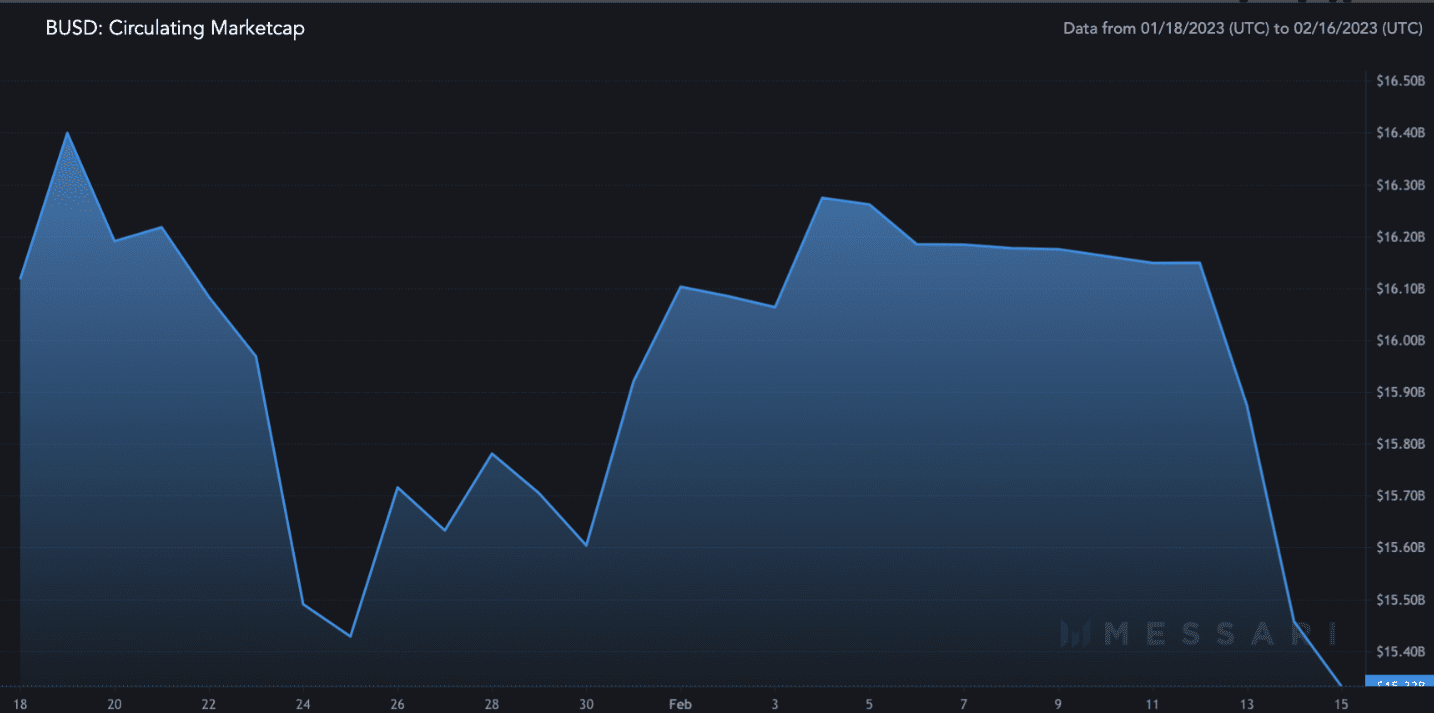

BUSD’s market value dropped by $2 billion

As is known, the SEC claimed that BUSD, a US dollar-backed stablecoin, is a security. The SEC also white-labeled Paxos, stating that the company violated investor protection laws.

As of February 17, the market value of BUSD has been withdrawn to 14 billion dollars.

USD Coin’s market cap is also shaky

USD Coin is the second largest stablecoin by market cap. However, USD Coin has been affected by the negative events in the stablecoin industry. The supply of USDC, on the other hand, fell from $41.29 billion to $40.99 billion from February 12 to February 14.

But that figure rose back to $41.30 billion on February 15 after Circle denied reports it was facing a lawsuit by the SEC.

Return of King: Tether (USDT)

Regulatory pressure from US regulators on stablecoin companies has been a boon for stablecoin Tether (USDT), which has put its market value above $69 billion.

In addition, the shared data reveals that approximately $ 890 million inflows since February 12 increased Tether’s market dominance to 51.25 percent as of February 15.