Bitwise withdraws ETF application; Binance offers users incentives to exit BUSD; Bitcoin futures at lowest level in last 5 months!

Bitwise withdraws ETF application

Bitwise requested to withdraw its Bitcoin and Ethereum Market Capitalisation Weighting Strategy exchange-traded fund (ETF) application to the SEC in early August. Bitwise’s move caused a surprise on the crypto side.

After Grayscale’s SEC victory, the market was on the rise with spring weather. However, Bitwise is reassessing its strategy. Bitwise’s withdrawal of its ETF application was unexpected. The company made a statement:

“The fund aims to provide investors with capital gains. No assurance can be given that the fund will achieve its investment objective.”

Bitwise chief investment officer Matt Hougan argued in a recent interview with Bloomberg that all ETFs should be approved by the SEC. ETF, Bitcoin determined by market capitalization. It aimed to invest in BTC futures contracts or Ethereum futures contracts.

Bitwise was among the first asset management firms to apply to the SEC for Bitcoin ETF products. In its application to the US securities regulator in January 2019, the company proposed the Bitwise Bitcoin Total Return Index, calculated based on the value of Bitcoin derived from BTC transactions on exchanges.

The company’s proposed Bitcoin ETF was prepared to draw market data from many crypto exchanges to provide a reliable representation of the broad crypto markets. The firm would also pave the way for third-party custodians to physically hold Bitcoin.

This is not the first time Bitwise has withdrawn its ETF application. Earlier this year, they submitted an application for the Ethereum Strategy ETF, designed to invest in Ethereum Futures. However, the asset manager withdrew this ETF just a week after applying.

Binance offers users incentives to exit BUSD

Binance offers various incentives for its users to exit BUSD.

According to Bloomberg, the leading cryptocurrency exchange is endeavoring to accelerate the process of users exiting BUSD by offering new incentives.

In a blog post published the other day, the company stated that users can switch from BUSD to First Digital Group’s token FDUSD without having to pay any transaction fees.

The exchange will gradually suspend BUSD support starting this month. The company wants its users to exit BUSD before February 2024.

Regulators’ pressure affected the exchange’s policy

Binance had previously announced various incentive programs for its users to turn to TrueUSD due to regulatory pressure.

Last February, Binance had to part ways with stablecoin issuer Paxos. Paxos, the company behind BUSD, Binance’s stablecoin, announced that it stopped issuing BUSD due to pressure from regulators. The company promised to support BUSD until February 2024.

The US Commodity Futures Trading Commission sued Binance and its founder Changpeng Zhao last March for violating derivatives regulations. The regulator accused the company of implementing fake compliance procedures. Binance stated that the lawsuit was a disappointment.

In June, the Securities and Exchange Commission sued Binance for operating an unregistered securities exchange and selling securities.

The FDUSD token promoted by Binance was introduced by First Digital last June. The asset is currently the fifth largest stablecoin on the exchange.

Bitcoin futures at lowest level in last 5 months!

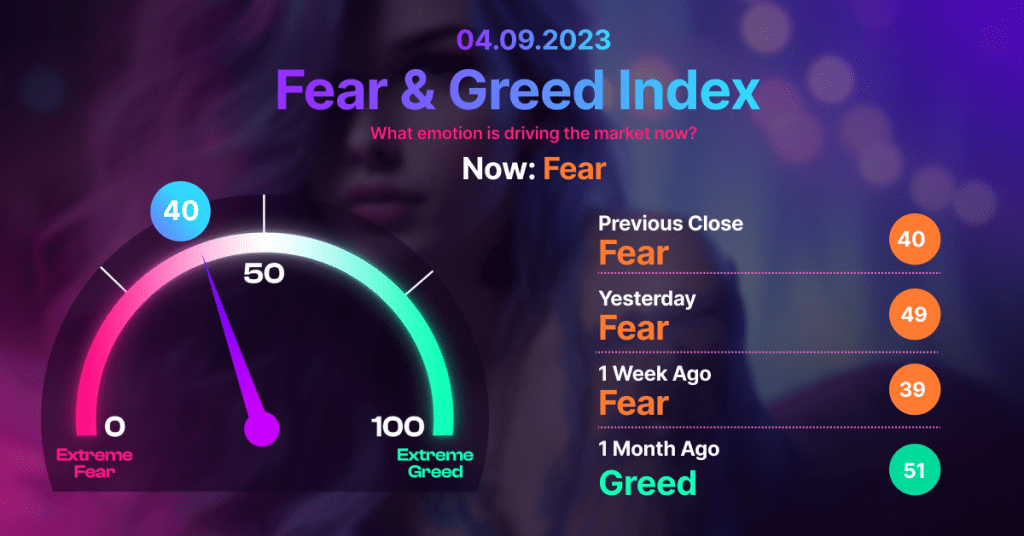

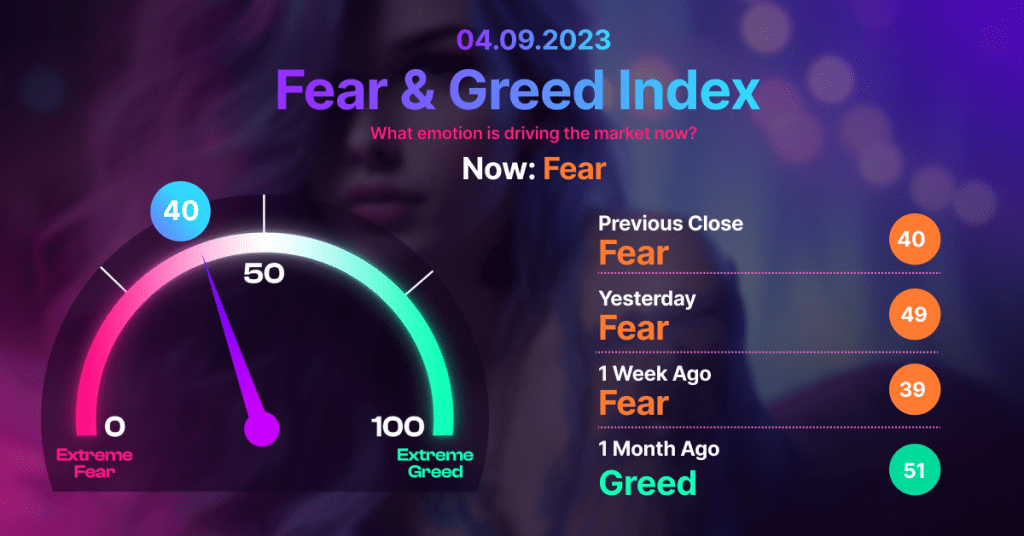

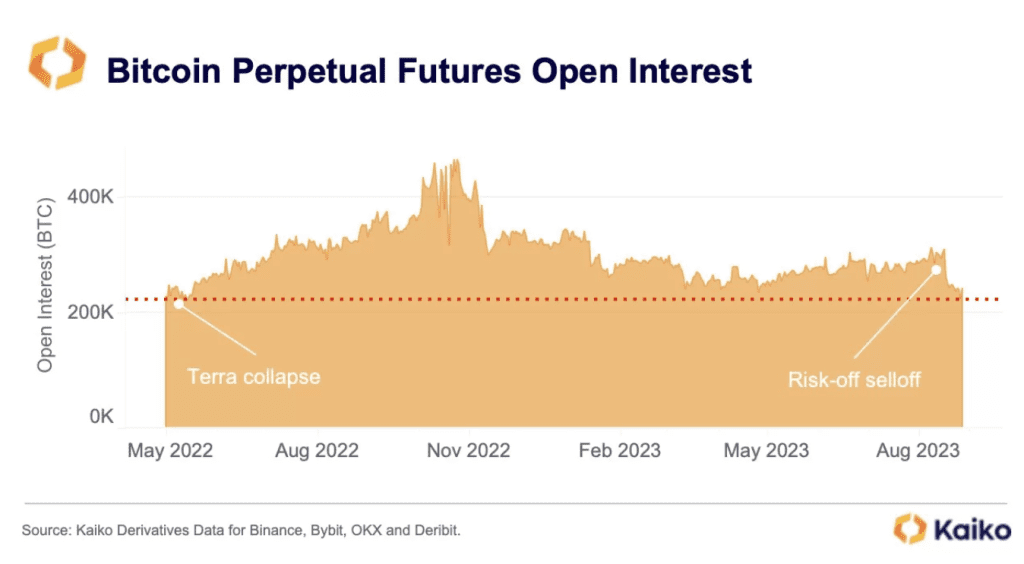

After the glorious rise in early 2023, the cryptocurrency market has entered a long period of decline again. In the crypto market, which has been showing signs of fatigue for a while, interest in Bitcoin’s (BTC) continuous futures has also decreased considerably. According to a recent report by Glassnode, open interest on Binance, the world’s largest cryptocurrency exchange by trade volume, has fallen to a 5-month low of $2.7 billion.

Grayscale victory gives hope to the crypto market

Although the trend in the cryptocurrency market is gloomy, Grayscale’s victory over the SEC on 29 August has instilled great morale in the market. In addition, despite the ongoing struggles in the spot market, the Grayscale victory signalled that something could change in sentiment.

On top of that, the open interest in Bitcoin futures contracts started to shift upwards. On-chain data tracking platform Kaiko reported that this important metric has been declining for some time, even falling to levels last seen following the collapse of the Terra network in May 2022.

Institutional investors have also started to reassess their positions following developments in the industry. In this case, it can be said that the decline in open interest rates indicates a change in investment strategy. According to experts, the excitement created by the Grayscale win is an encouraging sign.

Still, unless other positive triggers emerge, such as the long-awaited approval of the spot Bitcoin ETF, the market is likely to be shaped by caution and hesitation.

On the other hand, Bitcoin left behind a turbulent week in which it could not break the $ 26,400 level. The prolonged approval process of ETFs and indirectly the stagnation in Bitcoin has started to turn into disappointment among individual investors.