Understanding Crypto Staking

In the evolving world of cryptocurrency, staking has emerged as a significant method for token holders to earn rewards. This section delves into the foundational elements of crypto staking and the importance of rewards that come from this activity.

Basics of Crypto Staking

Crypto staking involves token holders participating as validators in a Proof of Stake (PoS) blockchain by locking their tokens into a staking contract and operating the necessary validator software. In return for their contribution to the network’s security and operations, they earn staking rewards. The rewards are generally proportional to the amount of cryptocurrency staked, incentivizing token holders to act honestly and support the blockchain’s stability and security. Any dishonest behavior could lead to validators losing their staked crypto.

Staking is instrumental in maintaining the integrity of a PoS blockchain, as the validators’ role is to approve legitimate transactions and create new blocks. The staked tokens serve as a form of security deposit, ensuring that validators have a vested interest in the accurate and honest processing of transactions.

Importance of Staking Rewards

Staking rewards serve as the primary incentive for token holders to engage in staking. These rewards can be an attractive source of passive income, allowing individuals to earn from their cryptocurrency holdings simply by holding funds in a crypto wallet and supporting the blockchain. The rewards may increase in value if the blockchain experiences growth and becomes more widely adopted.

The rewards are influenced by various factors, including the total amount of crypto staked, the duration of staking, and the specific staking platform used. Different platforms offer distinct APY rates, which stands for Annual Percentage Yield, reflecting the real rate of return on staking investments over a year, taking into account the effect of compounding interest.

Staking not only benefits the individual staker but also contributes to the overall health of the blockchain network. A robust network of stakers enhances the blockchain’s security and stability, making it more resistant to attacks and ensuring smoother operations.

Top Platforms for Staking

For individuals seeking to earn rewards on their cryptocurrency holdings, staking has emerged as a popular method. Staking involves holding funds in a crypto wallet to support the operations of a blockchain network. Below, we explore some of the top platforms offering competitive staking options and the highest Annual Percentage Yield (APY) for crypto staking.

OKX Staking Features

OKX is one of the world’s largest crypto exchanges and offers a fixed rate of 2% for USDT loans. It also displays 24-hour APYs for various assets, making it a go-to platform for those looking to delve into crypto lending. OKX’s staking features include:

- Fixed rates for certain assets

- Real-time display of APYs

- No platform fees for lending

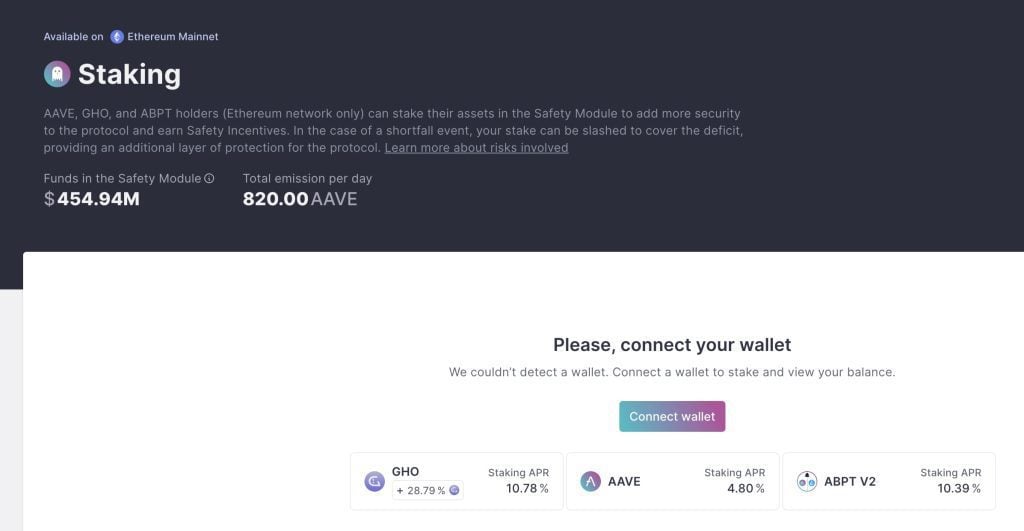

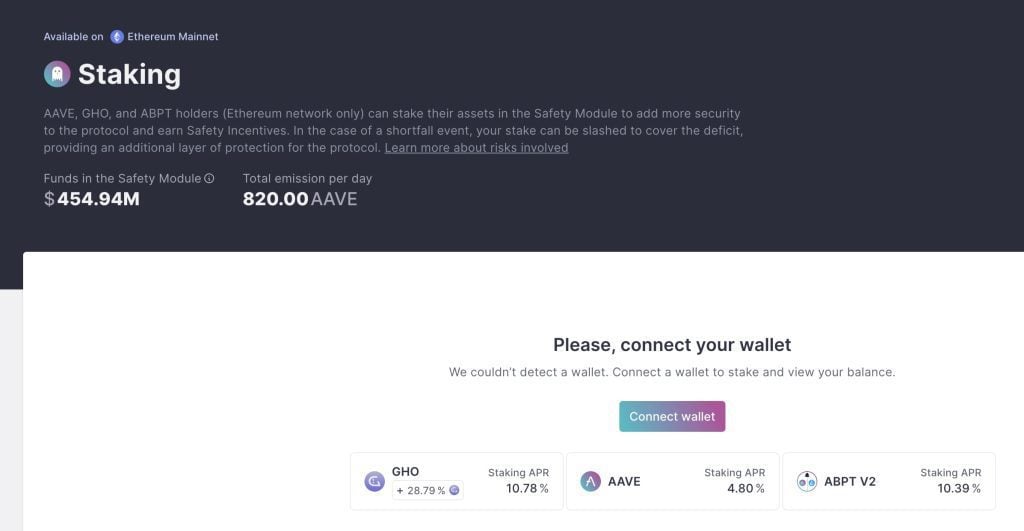

Aave’s Staking Options

Aave, a Swiss-based liquidity protocol, caters to 13 markets and presents a range of interest rates for lenders, from as low as 0.1% to as high as 18%. Borrowers can benefit from APRs starting at 0.1% for MKR and reaching up to 1.3% for BUSD, as noted on OKX. Aave’s staking options include:

- Multiple markets with competitive rates

- Varied interest rates for lenders and borrowers

- Access to a diverse range of assets

CoinRabbit’s Staking Benefits

CoinRabbit, headquartered in London, permits users to earn up to 10% interest on various projects. With APRs ranging between 12% and 16%, the platform is accessible for loans as small as $100 and supports a wide range of coins with no platform fees, as reported by OKX. CoinRabbit’s staking benefits encompass:

- High-interest rates on a variety of projects

- Low minimum loan amount

- Wide selection of supported coins

Midas.Investments APY Range

Singapore-based Midas.Investments presents APYs between 9% and 18% for most assets, with the possibility of an additional 2-3% APY if funds are staked in MIDAS tokens. However, it is worth noting that the platform engages in high-risk investment strategies. Midas.Investments’ APY range highlights:

- High APY for most assets

- Bonus APY for staking in MIDAS tokens

- High-risk, high-reward investment strategies

Nebeus Staking Opportunities

Nebeus, operating out of Ireland, allows users to gain 12.85% annually by lending crypto assets. The platform’s loans are backed by a $100 million insurance fund, and interest can be withdrawn daily in EUR or stablecoin form, according to OKX. Nebeus staking opportunities include:

- Attractive annual earning rate

- Loans insured by a substantial fund

- Daily interest withdrawals in EUR or stablecoin

Risks and Considerations

While the allure of earning high returns through crypto staking is strong, it’s crucial to understand the associated risks. In this section, we will outline the potential pitfalls that investors should be aware of before committing to staking their digital assets.

Market Volatility Risk

Market volatility remains the most significant risk in the realm of cryptocurrency. The value of staked assets can fluctuate wildly, and a steep decline in price can offset any interest earned, leading to net losses. For example, an annual percentage yield (APY) of 15% is of little comfort if the underlying asset’s value drops by 50% within the same period.

Liquidity Risk in Staking

Staking also introduces liquidity risk, especially with smaller, less-known altcoins that may lack sufficient market liquidity. This can make it difficult to sell or exchange staking rewards at a fair price. Therefore, it’s advisable to stake more liquid assets with higher trading volumes to minimize this risk.

Lockup Periods and Risks

Certain staking opportunities involve lockup periods, which can be a double-edged sword. During these periods, the investor cannot access their staked assets. If the market price drops drastically during a lockup, the investor is unable to withdraw and sell their assets, potentially leading to reduced earnings. Opting for assets that do not require lockup periods can help mitigate this risk.

Rewards Duration Risk

The frequency of reward payouts can vary across staking assets. Some may not distribute rewards daily, leading to delays in receiving them. By selecting assets that provide daily payouts, investors can reinvest their rewards promptly, potentially increasing overall returns.

Validator Operation Risks

Operating a validator node comes with its own set of challenges and requires technical know-how. Validators need to maintain operations continuously, as any downtime or misbehavior can result in penalties or a portion of the staked tokens being forfeited. Delegating staking to a reputable and reliable provider can help reduce this risk.

Investors must weigh these risks against the potential rewards of crypto staking. While the promise of high APY is enticing, a comprehensive understanding of the associated risks is essential for informed decision-making. By considering these factors, one can better navigate the staking landscape and select opportunities that align with their risk tolerance and investment goals.

Calculating APY in Crypto

Annual Percentage Yield Explained

Annual Percentage Yield (APY) is a financial metric used to assess the total amount of interest earned on an investment over a year, considering the effect of compounding. In the realm of cryptocurrency, APY is crucial for evaluating the potential returns from staking digital assets. Unlike a simple interest rate that only considers the interest on the original investment, APY provides a more accurate reflection of the return, incorporating the interest earned on previously accrued interest.

Factors Affecting APY

Several factors can influence the APY of crypto staking:

- Compounding Frequency: The more frequent the compounding periods, the higher the APY, as it allows the interest to be compounded on top of previously earned interest more often.

- Asset Price Fluctuations: The volatility of cryptocurrency prices can affect the staked asset’s value, thereby influencing the actual returns in terms of fiat currency.

- Staking Duration: Some staking options have a minimum duration requirement, which can impact the interest rate offered and, consequently, the APY.

- Inflation: Inflation can diminish the value of the returns if the rate of inflation surpasses the APY.

- Supply and Demand: The dynamics of supply and demand for the staked cryptocurrency can affect its value and the associated staking rewards.

Investors should consider these factors, along with the platform’s reliability and the inherent risks of cryptocurrency, when calculating APY and making staking decisions. For more information on staking, its benefits, and how to get started, refer to our comprehensive guide on best staking crypto.

Best Cryptocurrencies for Staking

Staking cryptocurrencies can offer investors an opportunity to earn interest on their holdings, and identifying the highest-apy-crypto-staking opportunities is key for those looking to maximize their returns. Here we explore some of the top cryptocurrencies for staking, based on their potential APY and the unique benefits they offer.

Ethereum Staking Overview

Ethereum, being one of the most prominent blockchain platforms, has garnered significant attention with its transition to Ethereum 2.0. This upgrade introduces staking, allowing investors to earn rewards for securing the network. Ethereum has already locked in $21 billion in the Ethereum 2.0 staking pool, signifying its massive ecosystem and widespread adoption. However, staking ETH involves risks, as staked amounts could be locked until the “Shanghai” upgrade, which is anticipated for 2023 or beyond.

Cardano Staking Potential

Cardano, a notable Layer 1 blockchain competitor to Ethereum, offers a market capitalization of $37 billion. It stands out for providing competitive APR rates often without mandatory lock-up periods, making it a flexible option for investors. Cardano’s staking system is designed to be accessible and user-friendly, ensuring that even those new to staking can participate.

Tezos Staking Benefits

Tezos is another blockchain that offers staking, known as “baking,” to its users. It is recognized for its formal governance system that allows for seamless upgrades without hard forks. Staking Tezos can provide participants with a steady APY, contributing to the overall stability and security of the Tezos network. The self-amendment capability of Tezos also means that stakers can expect a constantly evolving and improving staking experience.

Solana Staking Advantages

Solana’s blockchain is valued for its high throughput and low transaction fees, making it an attractive platform for developers and stakers alike. With a market cap nearing $12 billion, Solana offers no minimum staking requirements, which allows for broad participation. Its competitive APRs position Solana as an appealing choice for those looking to stake their crypto holdings. Solana’s robust infrastructure and growing ecosystem continue to attract more users to its staking program. For insights into Solana’s staking process, check out what is Solana phone.

Polkadot Staking Opportunities

Polkadot provides a unique staking experience with its estimated APR of 14.34% for delegators and 15.31% for those running a validator, according to Koinly. This high yield is partly due to Polkadot’s unique consensus mechanism, which encourages active participation in the network’s security. Centralized staking providers offer APRs ranging from 7% to 14%, making Polkadot an attractive option for investors seeking high returns on their staked assets.

| Cryptocurrency | Estimated APR | Market Cap | Notable Features |

|---|---|---|---|

| Ethereum (ETH) | Variable | $21 billion (locked in staking) | Transition to Ethereum 2.0 |

| Cardano (ADA) | Competitive | $37 billion | No lock-up periods |

| Solana (SOL) | Competitive | $12 billion | No minimum staking |

| Polkadot (DOT) | 7% – 15.31% | N/A | High yield for validators |

Staking these cryptocurrencies can offer substantial rewards, but it’s important to consider factors such as market volatility and lock-up periods, which can affect the overall profitability and accessibility of staked assets. For a more comprehensive look at the risks and rewards of crypto staking, delve into our comprehensive guide on the challenges in staking.

Benefits and Challenges of Crypto Staking

Crypto staking is an increasingly popular method for cryptocurrency holders to increase their holdings and support blockchain networks. As with any investment strategy, it comes with its own set of advantages and potential pitfalls.

Network Security and Stability

Staking strengthens the security and stability of a Proof of Stake (PoS) blockchain network. By incentivizing validators and delegators with rewards, the network ensures that there is a vested interest in maintaining the blockchain’s integrity. Validators are responsible for creating new blocks and confirming transactions, while delegators support validators by staking their own tokens, contributing to the overall robustness of the network.

Future Trends in Crypto Staking

The future of crypto staking is likely to see continued growth as more blockchain projects adopt the PoS model. Innovations in staking models, such as liquid staking, aim to address some of the current challenges by allowing participants to stake assets without sacrificing liquidity. Technological advancements and increased educational resources will also likely lower the barriers to entry, making staking more accessible to a broader audience. To stay updated on the latest developments in crypto staking and emerging opportunities, keep an eye on what-is-bonk and what-is-brett for the latest cryptocurrency trends.

As with any investment, it is crucial for participants to conduct their own research and consider their risk tolerance before engaging in staking. Despite the challenges, the potential for passive income and the opportunity to contribute to the security of blockchain networks make staking an attractive option for many in the cryptocurrency community.