In Todays Headline TV CryptoDaily News:

Visa’s crypto strategy remains intact.

U.S. payments giant Visa remains committed to investing in the crypto sector and supporting the technology despite recent failures in the industry, the company confirmed.

Robinhood subpoenaed by SEC.

Robinhood Markets Inc. said the Securities and Exchange Commission was probing its cryptocurrency business, in the latest signal that the regulator is drilling deeper into virtual asset platforms. The brokerage received an investigative subpoena in December related to its cryptocurrency listings and custody.

OK says it holds $8.6 billion in Bitcoin, Ethereum and dollars.

KX, the world’s second-largest crypto exchange by trading volume, has revealed it holds $8,6 billion in Bitcoin, Ethereum and US dollars. The Web3 platform published its fourth monthly proof-of-reserves to allow users to view the reserves as well as using open-source tools to check their liabilities.

BTC/USD dove 1.3% in the last session.

The Bitcoin-Dollar pair plummeted 1.3% in the last session. The RSI is giving a negative signal. Support is at 22796.6667 and resistance at 24244.6667.

The RSI is giving a negative signal.

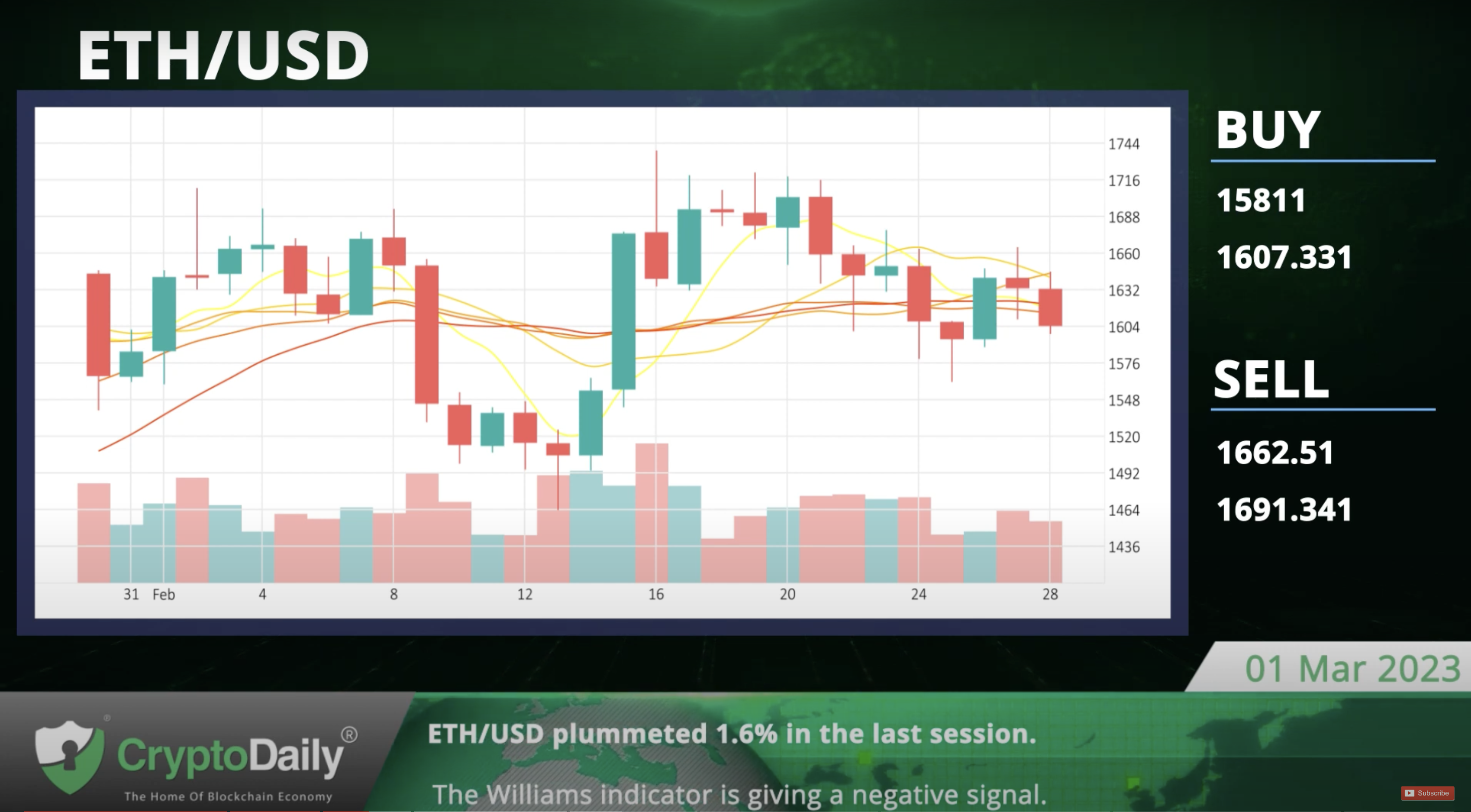

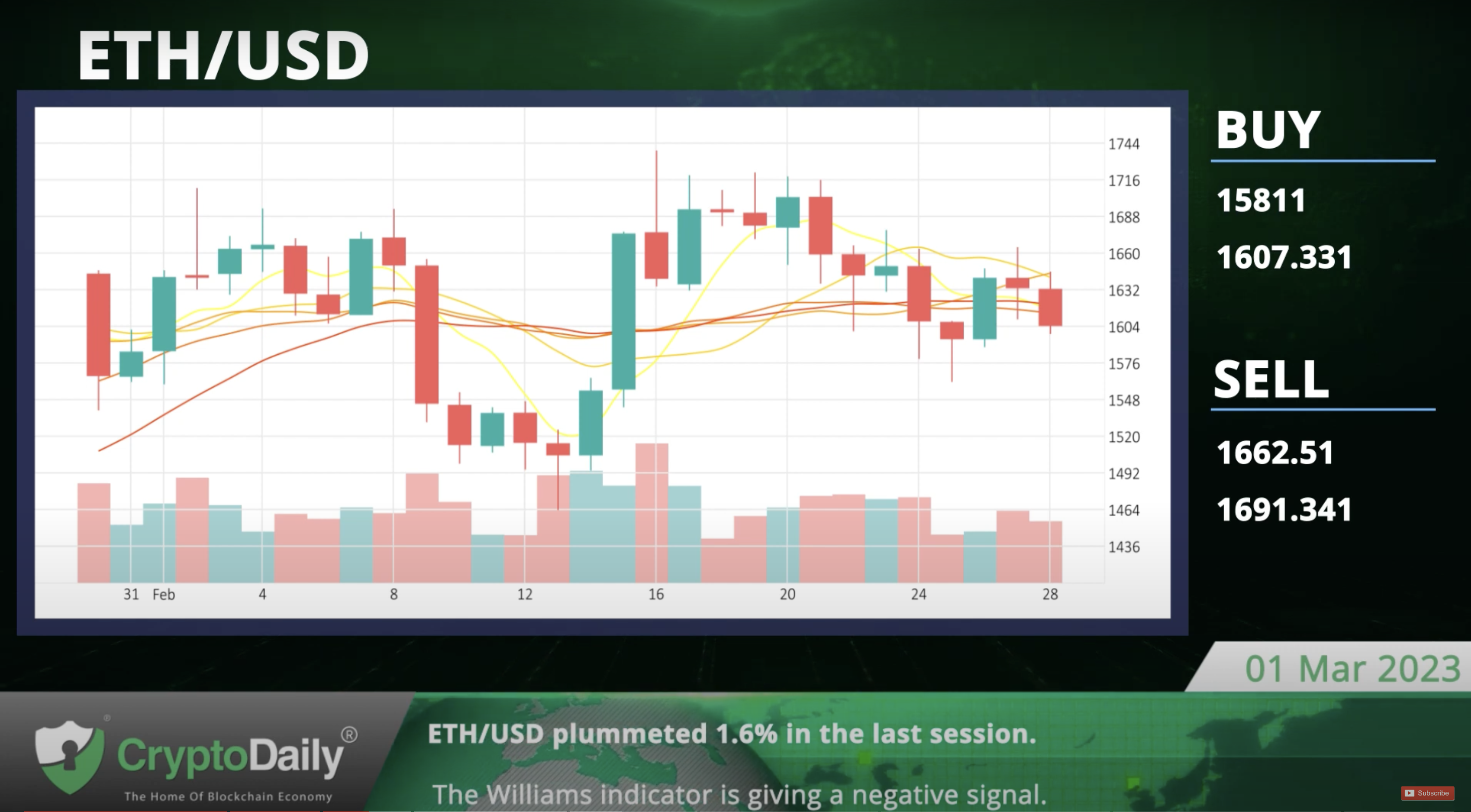

ETH/USD plummeted 1.6% in the last session.

The Ethereum-Dollar pair dove 1.6% in the last session. The Williams indicator is giving a negative signal. Support is at 15811 and resistance at 1691.341.

The Williams indicator is giving a negative signal.

XRP fell 0.4% against USD in the last session.

The Ripple-Dollar pair dropped 0.4% in the last session after rising as much as 1.0% during the session. The Stochastic indicator is giving a negative signal, which matches our overall technical analysis. Support is at 0.3672 and resistance at 0.3858.

The Stochastic indicator is currently in negative territory.

LTC/USD fell 0.8% in the last session.

The Litecoin-Dollar pair dropped 0.8% in the last session after rising as much as 2.0% during the session. The MACD is giving a negative signal. Support is at 90.7767 and resistance at 97.7167.

The MACD is currently in negative territory.

Daily Economic Calendar:

JP Jibun Bank Manufacturing PMI

The Jibun Bank Manufacturing PMI gives an early snapshot of the health of the Japanese manufacturing sector. Japan’s Jibun Bank Manufacturing PMI will be released at 00:30 GMT, Australia’s Gross Domestic Product at 00:30 GMT, the US ISM Manufacturing Employment Index at 15:00 GMT.

AU Gross Domestic Product

The Gross Domestic Product is a measure of the total value of all goods and services produced by a country. The GDP is considered as a broad measure of economic activity and health.

US ISM Manufacturing Employment Index

The ISM Manufacturing Employment Index estimates the labour market in the manufacturing sector, taking into account expectations for future production, new orders, inventories, employment, and deliveries.

US ISM Manufacturing PMI

The ISM Manufacturing PMI shows the business conditions in the manufacturing sector. It is a significant indicator of the overall economic conditions. The US ISM Manufacturing PMI will be released at 15:00 GMT, Japan’s Foreign Bond Investment at 23:50 GMT, Germany’s Unemployment Change at 08:55 GMT.

JP Foreign Bond Investment

The Foreign Bond Investment refers to bonds issued in a domestic market by a foreign entity in the domestic market’s currency.

DE Unemployment Change

The Unemployment Change is a measure of the absolute change in the number of unemployed people using seasonally adjusted data. A rise in this indicator has negative implications for consumer spending.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.