Today, traders need to make sure they don’t miss important trades. This makes it imperative that they find a way to follow the market. Because traders can’t react fast enough to take advantage of changes in price to help them achieve optimal trades, they need help.

Achieving optimal trades means that crypto traders need to be awake throughout the day and ready to trade at any hour. Again, due to slowdowns in some trading exchanges and transaction times, some traders may miss out on certain profitable trades. The solution to these problems is that traders are now using cryptocurrency trading bots.

This article can help you figure out more about bitsgap vs classic bot. Then we think you’ll choose for yourself.

Trading Bot As It Is

A trading bot is a program used for automatic algorithmic trading. The bot connects to a crypto exchange via an API and allows you to place trades on your behalf as quickly as possible. The reaction speed of the algorithm is incomparable to manual input.

There are a lot of trading bots. Of course, it is very difficult to choose among all this variety, and the right choice is important not only for the success of trading, but also for the safety of your funds. Cryptocurrency traders can choose from a growing number of efficient automated trading platforms, each of which tries to simplify the whole process and allow anyone to make the most of their trading prospects.

You should pay attention to how long the bot has been on the market. Long-established bots are usually more trustworthy than new bots. The importance of thoroughly researching the software you want to use cannot be overemphasized, and you should avoid buying the first bot you see. Reputation is of paramount importance when choosing a reliable bot for cryptocurrency trading.

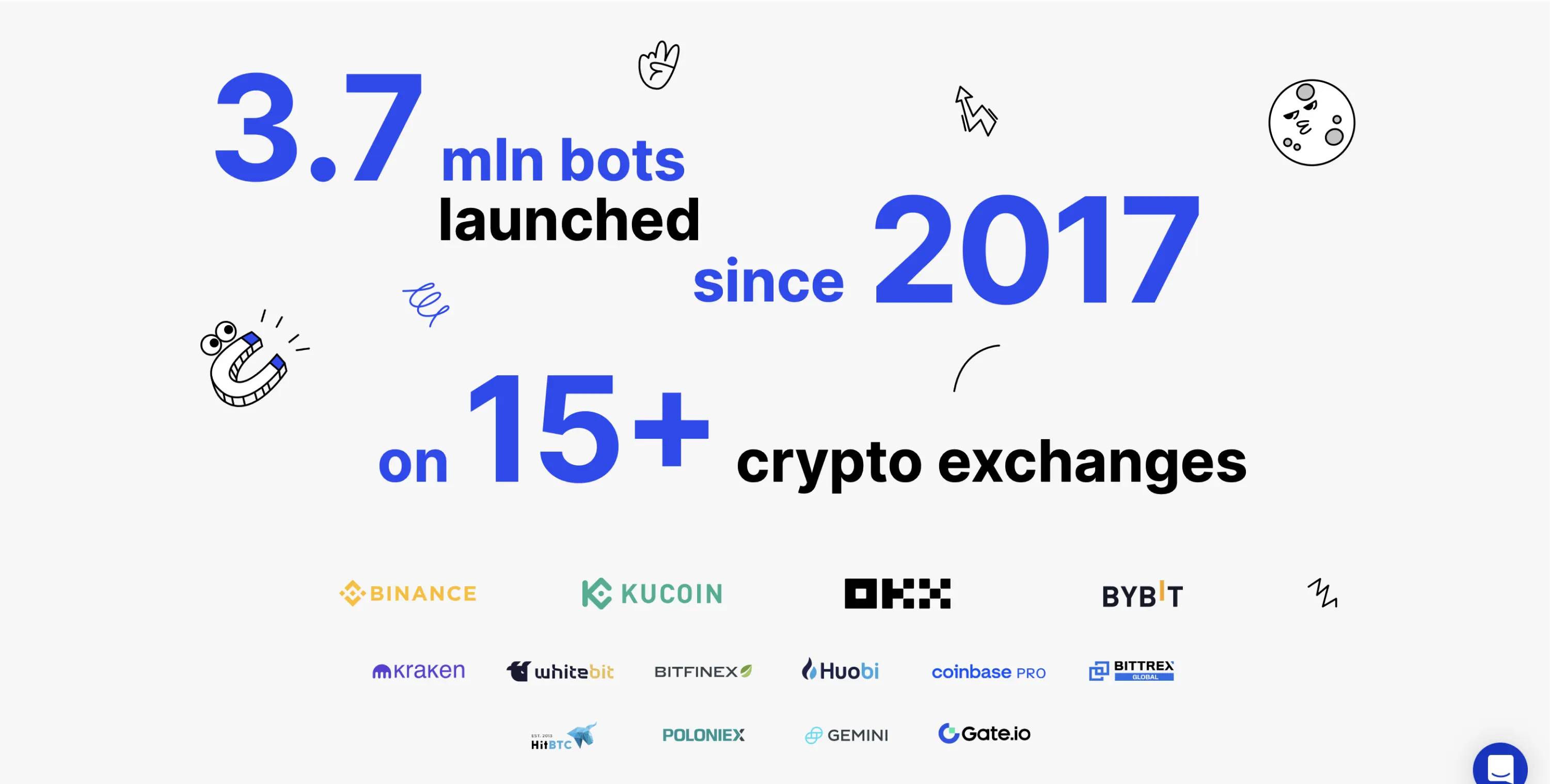

Supported Exchanges: Bitsgap vs Classic bot

You can place multiple buy and sell orders in either direction of the price, resulting in a trading grid of orders waiting to be executed. When the price on the spot reaches a predetermined target, a buy order is executed, and above it a sell order is placed on the grid. At the moment when the price in the process of growth reaches the next grid, the order on sale is executed that allows it to receive income from a price difference.

But what about bitsgap vs classic bot exchanges?

Exchanges that Bitsgap supports:

Binance, Bithumb, Bitfinex, Bitrex, Coinbase Pro, etc.

And exchanges that Сlassic Bot supports:

Binance, FTX, OKX, KuCoin, Coinbase Pro (GDAX), Binance US, BitMEX, etc.

Cryptocurrencies Comparison

Trading volume on cryptocurrency exchanges skyrocketed due to a massive influx of investors and traders. The market was hardly ready for such an influx.

Many traders have to manage multiple exchange accounts to gain access to certain markets and pairs or to take advantage of arbitrage opportunities.

In terms of features, classic bot and Bitsgap are very similar when it comes to combining exchange accounts and being able to access them from one place. However, there are some key differences: the classic bot has a copy-trading function, which allows users to copy other traders. Bitsgap, on the other hand, does not. However, Bitsgap has semi-automatic arbitrage, which allows users to automatically profit from arbitrage. Bitsgap does not have this feature.

Shadow orders is another feature that Bitsgap offers, but which is not available on classic bot. Orders can be executed only after the price reaches the desired target. This is especially useful to avoid frontrunners and if you want to reserve space without using available assets.

If you look at the platforms from a security perspective, they turn out to be very similar. The trading bots available on the platforms work in the cloud and do not require any software installation, which is a plus for people who value cybersecurity. Both platforms also do not require you to deposit any funds on them, you only need to connect your exchanges APIs and your funds can be safe. Finally, both platforms use two-factor authentication, which makes them less vulnerable to hacking.

Trading Tools

It can be time consuming and annoying for a user to switch from one exchange to another in pursuit of profitable trades. To solve this problem, Bitsgap has implemented a unified solution offering seamless trading with an intuitive interface.

Bitsgap is now integrated with more than 30 popular exchanges including Binance, Kraken and Bitfinex. It is a fully secure and reliably fast interface with a platform that has access to more than 10,000 cryptocurrency trading pairs.

Several indicators and bots are available to develop your strategies and make effective trading decisions.

naughtycrypto.io

Platforms Features

The Bitsgap features include:

- Shadow orders

This feature allows you to make hidden trades that are not in the order books, without reserving the available balance on the exchange. Orders can be placed only after the price has reached your target. This feature is indispensable if you want to place orders without using a portion of the available balance.

- Demo Mode

The demo mode allows you to test the features and performance of the bot without risking money. This is useful if you are new to crypto trading and don’t want to risk your portfolios. Once you are sure that your strategy works, you can start real trading.

- Semi-Automatic Arbitrage

This feature allows regular users to take better advantage of price differences between cryptocurrency markets and make profits.

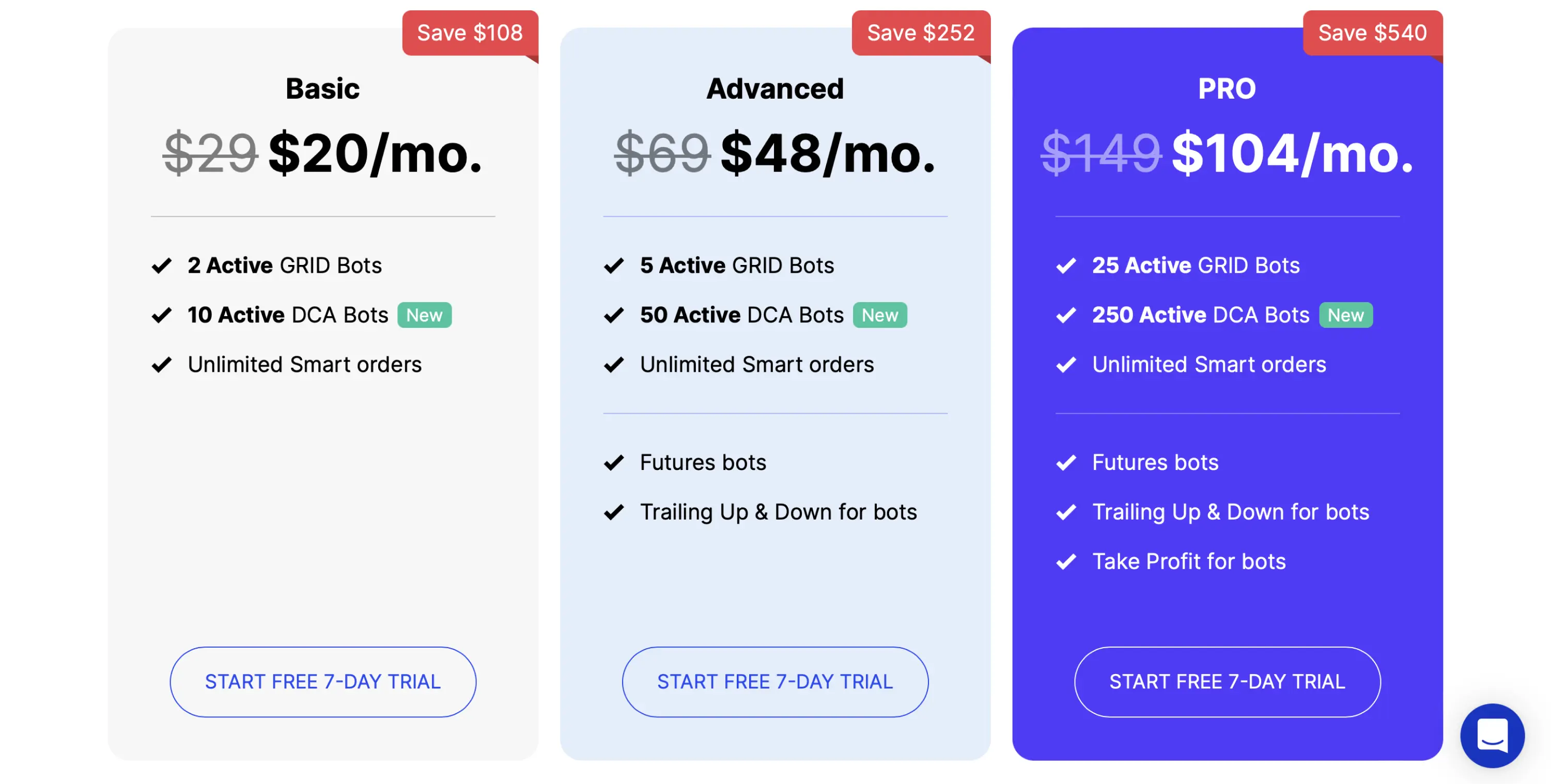

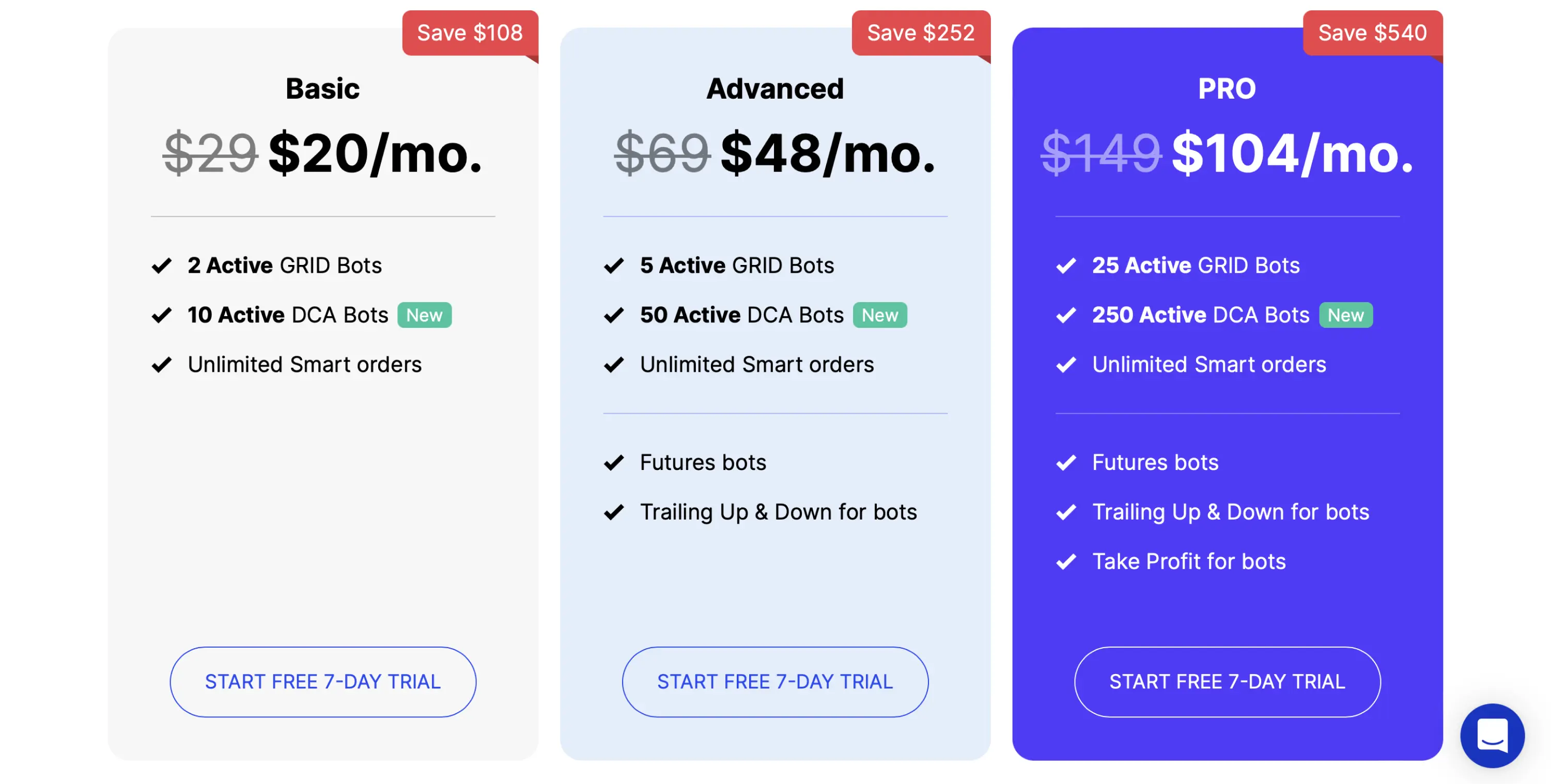

Pricing Plans & Subscription Structure Comparison

Bitsgap consists of:

- Basic Plan – The entry allows you to participate in multiple exchanges, access an inter-exchange portfolio, and set up trading signals.

- Advanced Plan – With a monthly trading limit of $100,000, the Advanced Account offers arbitrage trading, five active trading bots and future bots. You can save $6/month with an XNUMX months subscription.

- Pro Plan – The pro version has no monthly trading limit. You can use up to 20 active trading bots, future bots and trailing bots.

In addition, you get priority customer support for any questions. If you take a six-month subscription, the price drops to $123 per month.

You have a limited free trial for each of these plans, which gives you access to all the standard features. You can take advantage of the demo training mode to understand the functionality before upgrading to a paid subscription.

Customer Support

Cryptocurrency trading is completely legal, and so are the bots. Trading bots are technical and have been tried and tested in the stock and currency markets. However, not all brokers – including crypto-trading brokers – allow the use of bots. The quality of customer support also affects this.

So far, these two bots provide a pretty good level of customer care and provide feedback at any time.

Product Security

Security is always an issue when it comes to trusting your money to any service provider. With Bitsgap your funds are protected on the relevant exchange and connected via encrypted API keys.

These APIs do not reveal any sensitive information such as your password or personal information. The platform uses RSA 2048 encryption, making it twice as secure as most banks. Even employees don’t have access to sensitive data.

An extra layer of security comes with every login attempt. The system allows temporary blocking of both your account and your API if repeated failed attempts are made. You can further secure your account using 2FA authentication.

You don’t need to install anything to use classic bot. All bots work in the cloud, and you don’t need to keep your computer on all night for them to work. All it takes is setting up the bot online.

Сlassic bot also uses two-factor authentication. This extra layer of security is aimed at ensuring that no one else can access your account.

naughtycrypto.io

Strategies and Profitability

All trading bots for crypto trading can be divided into two categories. The first is arbitrage. This term stands for earnings on rate differences at trading platforms.

The second category of trading robots – market makers (Market making). Such bots are needed to make money on the spread – the difference between the best bid prices for selling and buying cryptocurrencies.

Both strategies bring good profits.

Recap: Pros and Cons

The advantages of both bots include:

- You can automate trading.

- Bot for trading is a tool, with the help of which you can get a lot of free time, without losing the efficiency of work.

- Bot for cryptocurrency trading can be customized to your trading style.

- The crypto bot allows you to work on several digital asset exchanges simultaneously and make transactions on a number of trading pairs in parallel.

- The automation of trading reduces the risk of missing moments to make a profitable deal.

- Robots have no emotions. Excluding this factor can increase the efficiency of work.

Among the disadvantages of these trading robots are the following points:

- Trading robots do not guarantee profitability.

- If the trading robot is inaccurately set up, the work of the program can lead to losses.

- Despite the high automation of the process, trading robots still need periodic control.

Recommended from Naughty Crypto: Bitsgap vs Binance Comparison

Conclusion

Trading bots are one way to start investing in cryptocurrency. A bot can send signals to its user or make trades automatically and at lightning speed. It can take the emotion out of cryptocurrency trading, which usually has a higher degree of risk than traditional investments.

Trading bots offer some obvious advantages, such as saving time in front of the screen, tracking price movements, identifying trends and executing trades at the right moment. However, you need to find the right bot for your specific requirements in terms of coding, pricing, strategy and functionality.

If a trader realizes that his trade lacks an attentive assistant or wants to delegate some of the routine work, he should pay attention to trading bots, which perfectly cope with these duties. For this reason, questions about what trading bots are are becoming more and more popular.

At first glance, the classic bot is the best option in terms of features and price. The platform offers most of Bitsgap’s features at a lower price, as well as those important features that Bitsgap does not have. Bitsgap, on the other hand, offers features that classic bot does not have, such as demo mode, automatic arbitrage and shadow orders.

Bitsgap reviews show that these features can be useful for some traders, but for the average user, classic bot is the clear winner.